iowa capital gains tax exclusion

Gains from the sale of stocks or bonds do not qualify for the deduction with the following exception. Or elect one lifetime election to exclude the net capital gains from the sale of farmland.

Pin By The Taxtalk On Income Tax Income Tax Income Tax

Herbert Clausen and Sylvia Clausen vIowa Department of Revenue and Finance Law No.

. Bonds and stocks other than a qualifying sale of employer securities of an Iowa corporation to an Iowa ESOP. Capital gains that qualify for the deduction result from the sale of real estate that is used in a trade or business in which the taxpayer materially participated for 10 years immediately before the sale and which has been held for at least 10 years immediately bore the sale. For example if a.

3 rows You can sell your primary residence exempt of capital gains taxes on the first 250000 if you. In addition a capital gain that qualifies for the deduction. Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two stiff tests.

A Like-Kind Exchange with a conservation agency might help you protect land while deferring capital gains taxes. Also the statute defines sale of a business as the sale of. IA 100A - IA 100F Capital Gain Deduction Information and Links to Forms Instructions 41-161.

Iowa has a unique state tax break for a limited set of capital gains. A capital gains deduction must be supported by a completed Form IA 100. Iowa tax law provides for a 100 percent deduction for qualifying capital gains.

A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if required for federal purposes. Iowa follows the section 1202 100 tax exclusion on capital gains from the sale of QSBS. Iowa capital gains tax exclusion Tuesday June 21 2022 Edit The current federal limit on how much profit you can make on the sale of your principal residence that you have held for at least 2 years before you pay capital gains tax is 500000 for a married.

Effective with tax year 2012 50 of the gain from the saleexchange of employer securities of an Iowa corporation to a qualified Iowa employee stock ownership plan ESOP may be eligible for the Iowa capital gain deduction. By Joe Kristan CPA. Iowa tax law generally follows the federal guidelines on the exclusion of gain on the sale of a principal residence.

Inheritance and Estate Tax and Inheritance and Estate Tax Exemption Iowas estate tax was repealed in 2008. The IDOR has recently issued three policy letters concerning various aspects of the Iowa capital gains exclusion the application of Iowa inheritance tax to trusts and whether the vehicle trade-in credit requires the same natural ownership. Individuals may not claim both the capital gains exemption and.

The most basic of the qualifying elements for the deduction requires the ability to count to 10 or five once retirement occurs. Enter the required information in the folder Capital Gain Deduction to calculate the IA 100. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

Individual income tax exclusion for capital gains narrowed Current Iowa law has complex rules governing the deductibility of certain capital gains. Installments received in the tax year from installment sales of businesses are eligible for the exclusion of capital gains from net income if all relevant criteria were met at the time of the installment sale. Investment property such as real property held for speculation but not used in a business.

Iowa tax law generally follows the federal guidelines on the exclusion of gain on the sale of a principal residence. You cant claim the capital gains exclusion unless youre over the age of 55. When a landowner dies the basis is automatically reset to the current fair market value at the time of death.

Iowa Capital Gains Deduction. Beginning in tax year 2023 Iowa farmers age 55 and older who farmed for at least 10 years but have retired from farming operations can elect an exemption of income from either cash rent or farm crop shares for all years the income is earned. If a farmer chooses to sell off their property and livestock rather than rent it out the individual would be eligible for a capital gains tax exemption.

Starting in 2023 Iowa Code 422721 would be amended to narrow this deduction to the net capital gain from the sale of real property used in a farming business if certain conditions are satisfied. The Taxpayer Relief Act of 1997 changed all of that. Therefore capital gains on the sale of QSBS will not only be excluded from federal income taxes but also state income taxes if all of the guidelines are followed.

It used to be the rule that only taxpayers age 55 or older could claim an exclusion and even then the exclusion was limited to a once in a lifetime 125000 limit. How does the capital gains exemption work for retired farmers. Kim Reynolds office Iowa Capital Dispatch is part of the States Newsroom a network of similar news bureaus supported by grants and a coalition of donors as a 501c3 public.

Division I Sale of Certain Qualified Stock Net Capital Gain Exclusion. The new law modifies Iowa Code 4227 to exclude from taxation capital gain arising from the sale or exchange of some employee-owned stock. The exemption applies to the sale of property cattle horses and breeding livestock.

Chart courtesy of Gov. At what age are you exempt from capital gains tax. Allocate capital gains Force Use these fields to allocate or adjust the amount of capital gains that were coded Iowa with a state use code 3 from federal data entry.

Iowans who receive stock from their employer as part of an employee stock ownership plan will be able to take a one-time exclusion of the sale or exchange of that stock from capital gains taxes. Iowa Department of Revenue IDOR Issues Several Rulings. The Legislative Services Agency estimated the farm capital gains tax exemption will cost the state an estimated 72 million in fiscal year 2024.

Iowa law Iowa Code 4227 21 provides that certain capital gains can be excluded from taxable income. For the sale of business property to be eligible the taxpayer must have either been employed in the business or materially participated in the business for ten years and held the property for ten years. Specifically employee-owners of a qualified corporation can make an election to exclude from Iowa taxation the capital gain from the sale.

Capital gains from sales of the following properties typically do not qualify for the Iowa capital gain deduction. Capital gains are taxed as ordinary income in Iowa. The amounts entered in this field override the.

Also The state of Iowa offers an Angel Investor Tax credit to stimulate capital investments from accredited investors. Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. June 23 2020 Blog.

32313 Crawford County District Court May 24 1995. The Iowa capital gains exclusion Iowa Code Sec.

Amendment To Sec 40 A Ia By Finance Act 2012 Retrospective Itat Http Taxworry Com Amendment Sec 40aia Finance Act 2012 Retrospe Finance Acting Investing

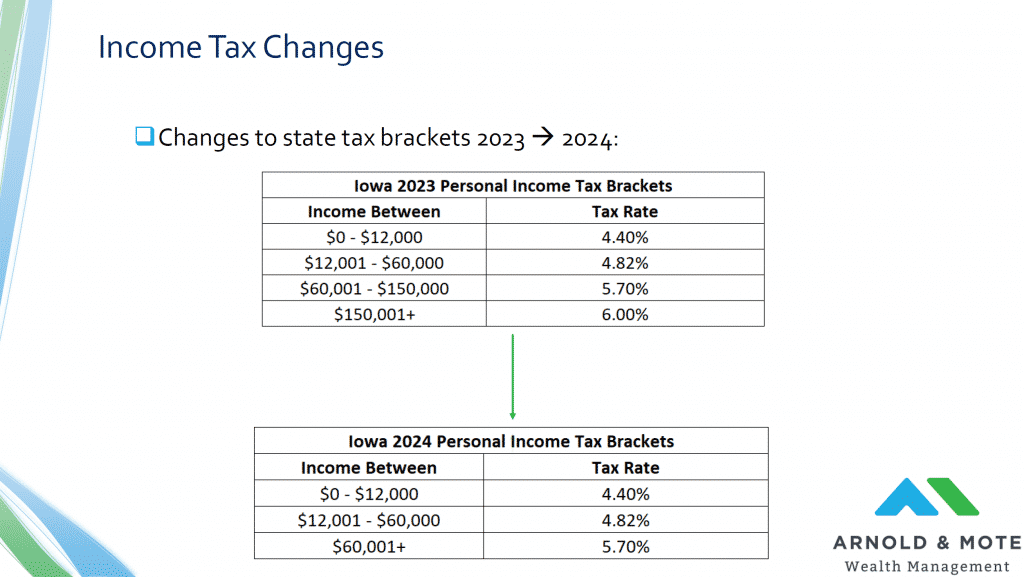

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Iowa Tax Reform Details Analysis Tax Foundation

What Changes Are Coming To The Iowa Tax Landscape And When

Income Tax Calculation Fy 2019 20 Salaried Employees Standard Deduction Rebate U S 87a Cess Youtube Standard Deduction Income Tax Income

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Paying Capital Gains Tax In Iowa Stocks Cryptocurrency Property

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

Notice From Cpc Tds To Persons Who Registered Home In Fy 2013 14 Who Should Not Bother Too Much Taxworry Com Cpc Bothered Capital Gains Tax

Iowa State 2022 Taxes Forbes Advisor

Tds Statement U S 194 Ia Now Rectifiable Taxworry Com Capital Gains Tax Transfer Pricing Taxact

Iowa Capital Gain Exclusion Inapplicable To Sale Of Partnership Interest Center For Agricultural Law And Taxation

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com

2021 Iowa Legislative Session Ends With Flurry Of New Tax Rules

Iowa S New Tax Structure In 2022 And Beyond

Tds On Interest On Loan Section 194a Tds On Interest On Loan Other Than Interest On Securities Loan Life Insurance Corporation Taxact

Capital Gains Tax Iowa Landowner Options

Iowa Legislature Sends Significant Tax Bill To The Governor Center For Agricultural Law And Taxation

Esteemed Premium Subscriber Dr S B Rathore Of New Delhi Has Asked Another Excellent Question Whether Minor Child Can File Filing Taxes Income Tax Tax Return